What is Alipay?

Anyone who has spent any time in China will know the importance of Alipay. With over 870 million active users as of 2018 and 100 million transactions made daily, Alipay is the most widely used third-party online payment service provider in China and is integral to daily life.

Established in 2004 in Hangzhou by Alibaba founder and Chinese business magnate Jack Ma, Alipay today operates alongside more than 65 financial institutions, including Visa and Mastercard, to enable payment services to both huge multinational corporations such as Taobao, as well as more than 460,000 online and local Chinese businesses.

The platform works on smartphones via the Alipay Wallet app, whereby users can scan QR codes and enable in-store payments, in addition to a range of services including peer-to-peer money transfer, bank account management, the paying of credit card bills, prepaid mobile top up, food ordering and taxi booking. In fact, just about any payment – from buying movie tickets to paying utility bills – can be conducted via the app, making it an indispensable tool for anyone visiting or living in China.

Currently, Alipay is used by over 300 merchants worldwide to sell directly to consumers in China, and is available in 18 foreign currencies, demonstrating its expansive reach and influence. In 2013 Alipay took over Paypal as the world’s largest mobile payment platform and continues to grow year on year.

New Functions for Overseas Visitors

Up until recently, Alipay could typically only be accessed using a Chinese bank account and phone number, making it difficult for those visiting for a short amount of time to use the app. Previously, those wishing to use Alipay without access to a Chinese bank account would require someone with a bank account to top up their account, and then pay them back – frequently in cash – a largely inconvenient and clumsy process.

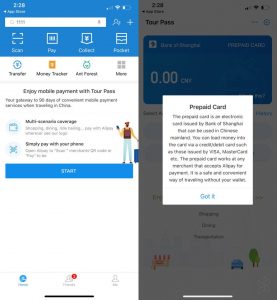

As of 5th November 2019, however, Alibaba-affiliated Ant Financial (formerly Alipay) announced that travellers in China would also be able to use Alipay’s services via an international version of the app. Given they have an overseas phone number, a valid visa and a bank card, users from abroad can use the ‘Tour Pass’ mini-app on Alipay to load money on to their account and use the app in the regular way. To do so simply requires downloading the app, entering an overseas phone number, choosing the amount you’d like to load and verifying your bank card to enable transactions via a prepaid card service.

Users then scan or show their QR code at Alipay enabled stores, providing a solution to the all too common problem of how to pay for products and services when visiting China.

With Alipay and WeChat pay having largely replaced the use of plastic cards and cash across China, this move to allow those from abroad use of the app aims to tap into the growing number of short term visitors to China. With 2018 seeing an influx of 31 million visitors to the country, contributing a total spend of $73 billion, there’s clearly a vast market to be explored when it comes to overseas travellers – whether visiting for work or tourism.

There are a couple of restrictions when it comes to using Alipay’s new ‘Tour Pass’, however. For example, there is a minimum top up amount of 100RMB ($14) and a maximum of 2000RMB ($285), and the card is only valid for 90 days, after which any remaining funds are refunded. These restrictions seem somewhat minor in comparison to the vast benefits offered by this new service.

How to use it ?

Step 1 – Download Alipay and sign up with your overseas phone number

Step 2 – Select the Alipay International Version and tap ‘Tour Pass’

Step 3 – Select the amount you want to load

Step 4 – Verify your identity and add your bank card information

Step 5 – Once you’ve loaded the money, you’re good to go. Scan or show your QR code to enable payments.

Response from Competitors

In response to this recent development, it is expected that Alipay’s rivals WeChat Pay and UnionPay will also look to opening up their services to visitors from overseas in the near future. On 6th November, just a day after Alipay’s announcement, Visa put out a statement in support of Tencent (the developer of WeChat), announcing that ‘[they are] excited to work with Tencent, one of China’s leading fintech companies, on a secure, convenient and interoperable mobile payment experience that will benefit the large number of international travelers visiting China.’

Clearly, this demonstrates a movement by WeChat to rival the latest update from Alipay, but an actual time frame for events is yet to be revealed.